Contents

- Stock Market Terms Every Beginner Trader Should Know

- Basic stock chart terms to know

- Matching Buyers to Sellers

“Non-fungible” indicates that it can’t be replicated or replaced with something else. Inflation is the rate of increase in prices for goods and services in the economy. When you find a term you don’t understand, come back to this post or search for the definition. They say the best way to learn a new language is through total immersion. That means that if you want to learn German, you should go live in Germany and speak German every day. A price rally is when a stock price rises at a noticeably quicker pace.

The stock market is a collection of markets from around the world. It’s where traders and investors buy and sell shares of companies. Understanding the stock market is essential to making informed trading decisions. You need to know how to choose the right stocks, which requires an in-depth understanding of a company’s annual report and financial statements. Learn how to understand what stock represents in a company and how to determine the true value of any stock. This allows you to make better investing decisions by avoiding the costly mistake of purchasing a company’s stock when the market has pushed its share price too high relative to its value.

- Among the three stores, ABC now makes an annual profit of $2.1 million.

- Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

- Many of the largest companies in the world choose to list their shares on the New York Stock Exchange.

- In 1990, it accounted for 60% (!) of the world’s market cap.

- But building a diversified portfolio of individual stocks takes a lot of time, patience and research.

On the other hand, investors who are conservative and require income from their portfolios may opt for stocks that have a long history of paying substantial dividends. Indices can be broad such as the Dow Jones or S&P 500, or they can be specific to a certain industry or market sector. Investors can trade indices indirectly via futures markets, or via exchange-traded funds , which act just like stocks on stock exchanges. There are plenty of catalysts that can push the market up or down. For example, in the 2022 stock market downturn, inflation pressures, supply chain issues, rising interest rates, and inflation fears were big reasons for the market’s poor performance.

Additionally, investing in the stock market can offer you a way to create passive income. Publicly traded companies can then use this money to work on projects such as new products, expanding operations, hiring, etc. Going public also affords companies the ability to attract top talent with stock options and provide current employees with equity. Now that you know what a stock and stock exchange is, what the stock market is, and what a brokerage is, let’s discuss how they all work together. These include the New York Stock Exchange , the Nasdaq, over-the-counter markets , and international stock exchanges. Many of these stock exchanges are linked together electronically.

They can be listed on the stock market or may only be available to private investors (OTC or over-the-counter stocks). Commonly traded stocks include Boeing, Xerox and Apple, the latter of which is traded on the Nasdaq 100, Dow Jones and the S&P 500. There are many ways to build a diversified stock portfolio, depending on whether you want to be an active or passive investor. An active investor will research stocks to find a collection of at least 10 companies across various industries that they believe will be winning investments over the long term. Meanwhile, passive investors let others do that work for them.

Stock Market Terms Every Beginner Trader Should Know

Traders will often want up-to-date price quotes to better analyze stocks and find decent trading set-ups. For example, the 20-day moving average is calculated by taking the price of the stock on each of the prior 20 days, then finding the average of those 20 prices. When going long, you purchase stock shares hoping to profit from an increase in the stock price. If a lot of buyers and sellers are actively trading stock, you’ll generally find it easier to enter and exit a position.

People can be excited to invest in these companies, but it’s good to keep the potential downside in mind. Dividend yield is quite easy to calculate and will often be explicitly stated next to a stock’s price as a percentage. To calculate this Yield %, just divide dividends the company paid for the year by the current share price. That time is when everyone around you is selling, and taking losses on their portfolio. It will pay you dividends that over time will compound and multiply. And if invested in a good company, the share price should rise substantially as well.

Basic stock chart terms to know

There are many levels of risk, with certain asset classes and investment products inherently much riskier than others. It is always possible that the value of your investment will not increase over time. For this reason, a key consideration for investors is how to manage their risk in order to achieve their financial goals, whether these goals are short- or long-term.

Initial Public Offering is another way by which company raise money from the investors. The two important exchanges of India are Bombay Stock Exchange and National Stock Exchange . First, the stock has to be actively traded — at least 100,000 shares in daily volume. If trading stocks below that level, you run the risk of being stuck in a position simply because there are no traders on the other side.

Matching Buyers to Sellers

Bar charts show the high and low prices with the closing price to chart its trend. The candlestick chart, on the other hand, uses green and red boxes to indicate periods of bullish and bearish. But this can be changed depending on which chart style investors are comfortable with and which data they are trying to look at. So far, identifying the labels in the stock quote might have been a little easy. This is an analyst’s estimate of what one share of stock will be worth in a span of a year. A beta of 1 or greater means the stock moves up or down more quickly than the market overall.

Although it no longer has the flexibility of a small business or the freedom to simply close shop, their company is now valued at $51 million. The couple’s 60% stake now has a total worth of $30.6 million. Although they own less of the company, the owners’ stake will hopefully grow faster now that they have the means to expand rapidly. Using the money from their public offering, ABC Furniture successfully opens two new stores and has $1.2 million in cash left over, since it raised $5.2 million but only used $4 million.

Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Stash does not guarantee any level of performance or that any client will avoid losses in the client’s account. Welcome to Stash101, our free financial education platform. Stash101 is not an investment adviser and is distinct from Stash RIA. Nothing here is considered investment advice. Yield refers to the income earned on investment over a set period of time, expressed as a percentage of your original investment. A stock split occurs when a corporation increases the number of its outstanding shares by distributing more shares to current stockholders.

Time Horizon

Before, the amount they could take out of the business was limited to the profit that was generated. Now, they can sell their shares in the company at any time, raising cash quickly. This practice allows an investor to look at a stock and know that it is worth, for instance, $40 per share. Business Growth Reports is the Credible Source for Gaining the Market Reports that will provide you with the lead your business needs. The market is changing rapidly with the ongoing expansion of the industry. Advancement in technology has provided today’s businesses with multifaceted advantages resulting in daily economic shifts.

The couple has managed to https://forex-trend.net/ off the company’s debt, and the profits are more than $500,000 per year. Convinced that ABC Furniture could do as well in several larger neighboring cities, the couple decides to open two new branches. To better understand how issuing stock works, take the fictional company ABC Furniture, Inc.

All https://topforexnews.org/s have to make money from their customers in one way or another. Many financial institutions have minimum deposit requirements. In other words, they won’t accept your account application unless you deposit a certain amount of money.

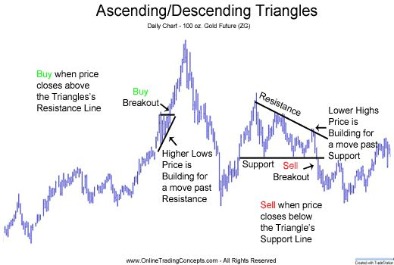

That said, there’s more to understanding how the stock market works. You have to beware of its very real dangers because it’s easy to lose if you don’t learn to invest in the market the right way. Photo by Ishant Mishra on UnsplashSupport and Resistance are levels at which stocks stay within a given period of time. Wing at these lines, the goal is to identify when to buy and when to sell. While there is no correct way to use these lines to know when to buy, and that every investor has different ways of interpreting these lines, it’s important to understand the process. Every dollar a company made, they are paying the indicated dollars per stock, price to earnings ratio, divide the current stock price by the earnings per share for the past year.

https://en.forexbrokerslist.site/ assumes no obligation to provide notifications of changes in any factors that could affect the information provided. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. There is no guarantee that any strategies discussed will be effective. When you come across a term you’re unfamiliar with in your own research, refer back to this post until you’ve mastered them. You’ll find that learning these stock terms for beginners is more doable than you think. Volume is a measure of how much a certain stock or other investment has been traded over a certain period of time.

FAQs About Stock Market Terms

Investors will own company shares in the expectation that share value will rise or that they will receive dividend payments or both. The stock exchange acts as a facilitator for this capital-raising process and receives a fee for its services from the company and its financial partners. The term stock market refers to several exchanges in which shares of publicly held companies are bought and sold.

A capital gain occurs when you sell a stock at a higher price than the price at which you purchased it. A dividend is the share of profit that a company distributes to its shareholders. They have contributed nearly one-third of total equity return since 1956, while capital gains have contributed two-thirds. Some stock markets rely on professional traders to maintain continuous bids and offers since a motivated buyer or seller may not find each other at any given moment. While buying and holding over the long term generally yields the best returns, it’s also essential to know when to sell stocks.

The New York Stock Exchange and the Nasdaq Stock Exchange are first on the list of the 1 Trillion Club, referring to securities exchange with a market capitalization of over 1 trillion. Once you know how to read stocks, you will learn that there’s a story behind charts and one of them is a glimpse of what’s happening in the broader market. You can minimize loss and maximize profit just by looking at how it’s projected to perform. It’s so much easier to just read a list of stocks that are best to buy and invest in, like this article we’ve put together. But what counts as the best stocks will be different for each investor and will be determined by each one’s goals.