The platform provides a wide range of tools and features to help you analyze the forex market, execute trades, and manage your positions effectively. Additionally, thinkorswim offers access to real-time market data, news, and customizable charting tools, enabling you to stay informed and make informed trading decisions. TD Ameritrade is a well-established online brokerage firm that offers a wide range https://forexbroker-listing.com/ of investment products, including forex trading. It provides a user-friendly platform, powerful tools, and educational resources to help traders make informed decisions. To start trading forex with TD Ameritrade, there are a few essential requirements to fulfill. Separately, the company has a desktop trading platform called thinkorswim that’s aimed at serious stock, ETF, futures and forex traders.

Understanding Forex Trading Services on TD Ameritrade

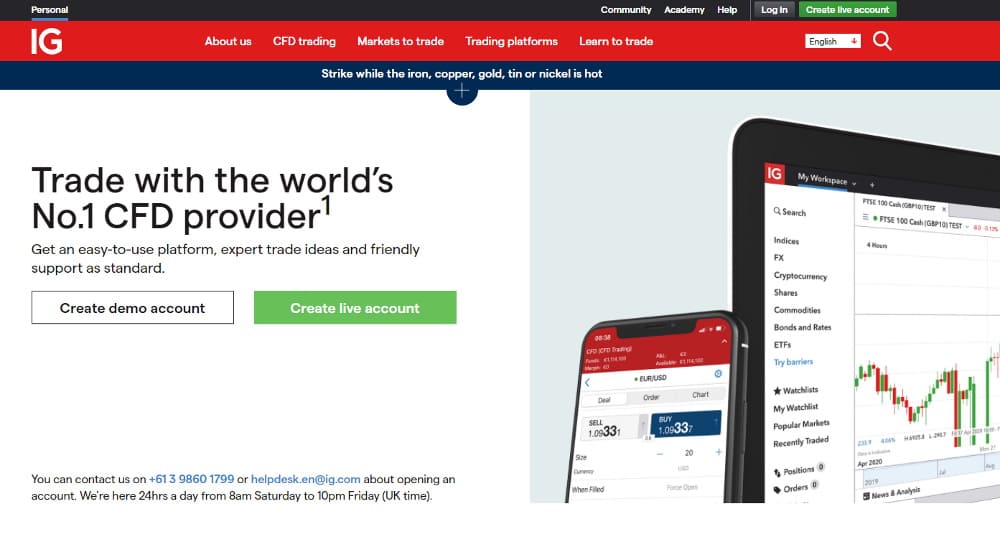

I’ve been working in the forex industry over the last 25 years, and in this guide I’ll help you quickly learn some key points about the U.S. forex brokerage landscape and what to look for when choosing a broker. At ForexBrokers.com, our reviews of online forex brokers and their products and services are based on our collected data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here). Schwab enjoys a dominant position in the equities markets and delivers strong research and educational content across a vast range of securities. Its award-winning thinkorswim platform (acquired as part of its merger with TD Ameritrade) remains one of the best in the industry. That said, the broker’s forex offering is still largely limited to what is available on thinkorswim.

TD Ameritrade Review 2024

Steven previously served as an Editor for Finance Magnates, where he authored over 1,000 published articles about the online finance industry. Steven is an active fintech and crypto industry researcher and advises blockchain companies at the board level. Over the past 20 years, Steven has held numerous positions within the international forex markets, from writing to consulting to serving as a registered commodity futures representative. Among the riskier elements of forex trading is the rapid pace at which transactions are carried out. Forex trades also often use high leverage, which means investors can quickly lose more than their initial investments.

What is the best forex trading app?

One of the most significant advantages of trading forex has been the high leverage you can apply to your trading, although using leverage can magnify your losses as well as your gains. Leverage in trading is thus a two-edged sword that must be used with prudence. Beginners should consider starting off with swing trading, which means holding an investment for more than one day and less than a couple of months. Wait until you have more experience before using options, short selling, and buying on margin. The SIPC insures $500,000 per account including up to $250,000 in cash against theft or the firm going belly-up.

Getting Started: A Beginner’s Guide to Trading Forex on TD Ameritrade

ForexBrokers.com has been reviewing online forex brokers for over six years, and our reviews are the most cited in the industry. Each year, we collect thousands of data points and publish tens of thousands of words of research. You also have access to powerful research and educational resources on Thinkorswim. The better you understand how markets work, the smarter your decisions will be. To begin trading forex on TD Ameritrade’s Thinkorswim platform, you will need to open an account specifically for forex trading and configure the necessary settings within the Thinkorswim platform.

We test all available trading platforms for each broker – whether they are proprietary or come from third-party providers – and evaluate them based on a host of data-driven variables. High-net-worth individuals can use credit lines with financial institutions to trade forex without a broker. You can also trade currency futures without a broker if you hold a seat on the CME exchange. Still, the easiest way by far to trade forex is via an online forex broker.

Its thinkorswim mobile, desktop, and web platforms are best for advanced traders searching for perks like real-time market alerts, stock scanners, options statistics, and more. There is a wide selection available, including apps that are developed by brokers in-house, as well as apps from third-party developers. To avoid forex scams, you ameritrade forex broker should only use regulated banks and brokers that are properly licensed to offer forex trading services in your country of residence. For example, if you live in the U.K., check the Financial Conduct Authority (FCA) to verify a broker is regulated. Forex trading has become increasingly popular among retail investors in recent years.

TD Ameritrade’s liquidation policy for forex trades is once daily for any account with a level of risk less than 100% when observed at 4 a.m. EST and intraday if the account falls to 25% or below, whichever comes first. An investment club account is an account owned by a group of people, usually a partnership, that contributes a pool of funds to be invested in securities. Dividends, capital gains, and losses are reported on the individual member’s taxes. However, it is important to note that leverage can amplify both profits and losses. Trading with high leverage carries a higher risk, as even a small adverse move in the market can result in significant losses.

While the CFTC develops and sets out the rules that govern how financial services companies must conduct themselves, the NFA issues licenses. We recommend eToro to anyone with a casual interest in day trading in search of a user-friendly trading platform. Cryptocurrency enthusiasts will also appreciate this broker’s focus on Bitcoin and other digital assets. NADEX offers both mobile and desktop platforms for maximum freedom and flexibility. Traders can access identical features and tools regardless of how and where they choose to trade. However, NADEX does stand out from other platforms we’ve profiled because it does not allow traders to find an account with credit.

Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. Among U.S. forex brokers registered with the CFTC and regulated by the NFA, only three brokers offer MetaTrader, including OANDA, FOREX.com, and IG. It’s worth noting that OANDA and FOREX.com offer the full MetaTrader suite, including Metatrader 4 (MT4) and MetaTrader 5 (MT5), while IG only offers the MT4 platform.

- TD Ameritrade also offers non-tax-deferred custodial accounts, which are types of custodial accounts to which a parent or guardian can contribute funds until the beneficiary meets the state’s age requirement.

- This dealing desk account offers a variable spread that starts from 1.0 pips but affords customers access to a comprehensive range of assets to trade.

- Trading currency focuses on global markets while stocks are more about companies’ success.

TD Ameritrade also provides risk management tools, such as stop-loss orders and trailing stops, to help you limit potential losses and protect your capital. These tools can be set at the time of trade execution or adjusted later as the market moves. This broker allows traders to fund their accounts with popular cryptocurrencies like ETH, BTC and XRP. Forex trading in the USA is regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These organizations set strict rules and regulations to protect traders and ensure the market’s integrity. Our forex comparisons and broker reviews are reader supported and we may receive payment when you click on a link to a partner site.

Of course, leverage means you can also profit at the same speed, which — combined with liquidity — is what attracts investors to currency trading. Existing Bank of America customers may also prefer the simplicity of trading on Merrill Edge’s investment platform. Non-profit organizations not charted as corporations can open a non-incorporated cash account, cash and margin account, cash and options account, or cash, margin, and options account. June 13, 2022, the SEC charged three Charles Schwab investment advisors $187 million for a lack of transparency with clients regarding the management of their funds. You can also access bond-specific tools, like the Bond Wizard, Bond Calculator, and Bonds Alerts. The Bond Wizard tool allows investors to determine the cost and yield of their bonds.

Corporate accounts offer additional protection benefits, such as liability protection and account flexibility. A TD Ameritrade trust account allows investors to transfer assets to one or more trustees. TD Ameritrade offers trusts for taxable living, revocable, testamentary, and irrevocable trusts. Save for college and educational expenses with TD Ameritrade 529 college savings plans and Coverdell Education Savings Accounts (ESAs). The Coverdell ESA offers tax-free distributions, with a $0 minimum deposit and a $2,000 annual maximum contribution limit. TD Automated Investing accounts can be opened as individual brokerage accounts, joint tenants with Rights of Survivorship taxable accounts, traditional IRAs, and Roth IRAs.

Interactive Brokers also began offering some cryptocurrency trading in 2021. You’ll be able to trade popular cryptocurrencies such as Bitcoin and Ethereum at attractive commissions. Our experts at Compare Forex Brokers have hand-checked all the data provided through the Forex Brokers USA Review for accuracy. Traders interested in learning more about exotic derivatives and options contracts can do so on NADEX with the peace of mind that comes from trading with a regulated platform.