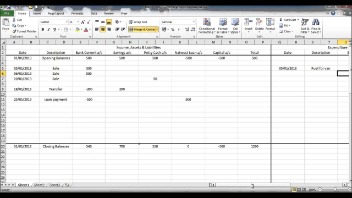

It’s important to perform a bank reconciliation periodically to identify fraudulent activities or bookkeeping and accounting errors. This way, you can ensure your business is in solid standing and never be caught off-guard. NSF cheques are an item to be reconciled while preparing the bank reconciliation statement.

Step 5: Create journal entries

Thus, such debits made by the bank directly from your bank account lead to a difference between the balance as per cash book and the balance as per the passbook. Such a time lag is responsible for the differences that arise in your cash book balance and your passbook balance. However, in the bank statement, such a balance is showcased as a debit balance and is known as the debit balance as per the passbook. The above case presents preparing a https://www.quickbooks-payroll.org/ starting with positive bank balances. Nowadays, many companies use specialized accounting software in bank reconciliation to reduce the amount of work and adjustments required and to enable real-time updates.

How confident are you in your long term financial plan?

And if you’re consistently seeing a discrepancy in accounts receivable between your balance sheet and your bank, you know you have a deeper issue to fix. If there’s a discrepancy between your accounts and the bank’s records that you can’t explain any other way, it may be time to speak to someone at the bank. In huge companies with full-time accountants, there’s always someone checking to make sure every number checks out, and that the books match reality. In a small business, that responsibility usually falls to the owner (or a bookkeeper, if you hire one. If you don’t have a bookkeeper, check out Bench). To do this, a reconciliation statement known as the technical analysis for dummies 3rd edition by barbara rockefeller is prepared. Businesses maintain a cash book to record both bank transactions as well as cash transactions.

Fraudulent activity

In these cases, journal entries record any adjustment to the book’s balance. After fee and interest adjustments are made, the book balance should equal the ending balance of the bank account. The frequency of reconciling bank statements depends on the size and complexity of the business and its transaction volume. For larger companies with a high volume of transactions, it’s advisable to reconcile bank statements daily to ensure that any discrepancies or errors are promptly identified and corrected.. Completing a bank reconciliation entails matching the balances on your bank statement with the corresponding entries in your accounting records. The process can help you correct errors, locate missing funds, and identify fraudulent activity.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

- If you’ve fallen behind on your bookkeeping, use our catch up bookkeeping guide to get back on track (or hire us to do your catch up bookkeeping for you).

- A bank reconciliation statement can help you identify differences between your company’s bank and book balances.

- Bank reconciliation is the process of matching the bank balances reflected in the cash book of a business with the balances reflected in the bank statement of the business in a given period.

- You first need to determine the underlying reasons responsible for the mismatch between balance as per cash book and passbook.

Step 1. Choose Your Method for Reconciliation

Or, if you use accounting software to track your business’s finances and generate financial statements, the software should have a built-in method to speed up bank reconciliation. A bank reconciliation statement is important in managing your busines finances. This document can help ensure that your bank account has a sufficient balance to cover company expenses. It’s a tool for understanding your company’s cash flow and managing accounts payable and receivable. If you haven’t been using bank reconciliation statements, now is the best time to start. How you choose to perform a bank reconciliation depends on how you track your money.

Miscellaneous debit and credit entries in the bank statements must be recorded on the balance sheet. If there are any differences, adjust the balance sheet to reflect all transactions. Designed to keep your bank and your G/L in balance, the bank reconciliation process also helps you correct possible errors, account for uncashed checks, and even locate missing deposits. In accounting, a company’s cash includes the money in its checking account(s).

By using pre-configured templates, it simplifies the management of open items and enhances analytical capabilities. Discrepancies between the balance sheet and https://www.business-accounting.net/three-way-matching/ the bank statement must be identified and resolved promptly. Failure to do so can lead to further errors and make it challenging to reconcile the accounts.

When you finish reconciling accounts, QuickBooks automatically generates a reconciliation report. It summarizes the beginning and ending balances, and it lists which transactions were cleared and which were left uncleared when you reconciled. This report is useful if you have trouble reconciling the following month. Automating bank reconciliation can bring numerous benefits to a business, including increased accuracy, productivity, and cost savings. By using software tools to automate bank reconciliation, businesses can focus on other critical tasks and make informed business decisions based on accurate financial data. The bank statement and the company’s records now both show a $6,975 balance.

Most reconciliation modules allow you to check off outstanding checks and deposits listed on the bank statement. After reviewing all deposits and withdrawals, adjusting the cash balance and accounting for interest and fees, your ledger’s ending balance should match the bank statement balance. If the two balances differ, you’ll need to look through everything to find any discrepancies.